Contents:

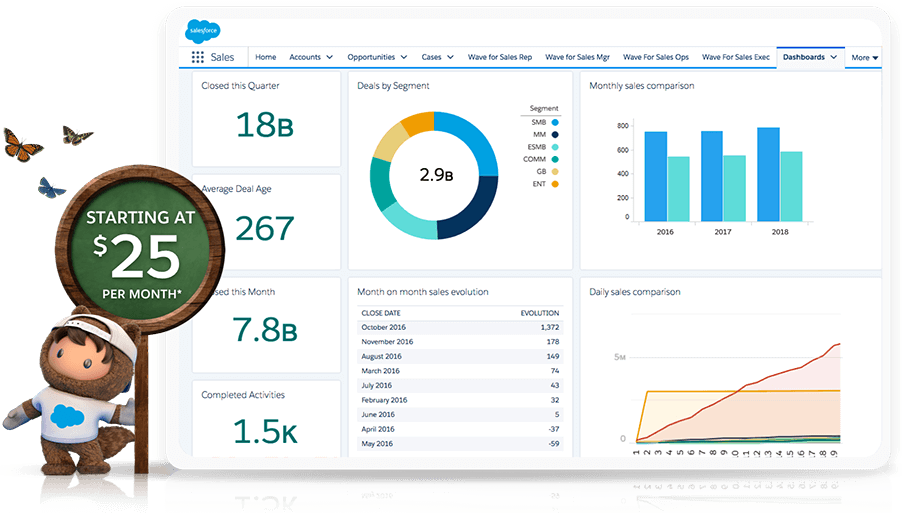

On the other hand, a higher value may be a sign of weak credit policies, which can be seen as a matter of concern. The reason for higher value can be that customers are taking more time to pay, or the salespeople are offering longer terms of payment to drive increased sales. Automating the accounts receivable process is simple when you use accounting software that integrates with your payment system and business bank account. A DSO value less than 45 days is great — it means your customers pay you within an average of 45 days.

It also automatically sends reminders to customers as their payment due dates near, as well as providing finance teams with visibility down to the individual customer and invoice. These robust capabilities can help companies improve their liquidity, fund growth, shorten the credit-to-cash cycle and seize new investment opportunities as they arise. An automated platform can streamline your credit and collections further.

Why The Simple Method to Calculate DSO Is Not Enough.

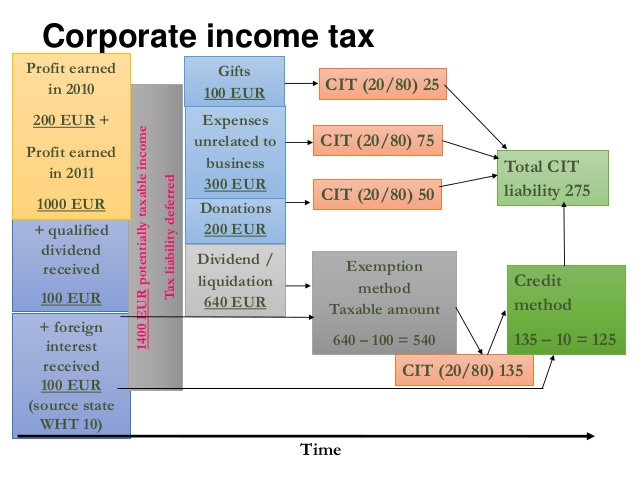

Unfortunately, the conventional methodology for calculating days sales outstanding weighs heavily on a company’s average annual sales, or a running 12 month average. Consequently, this approach overlooks the impact seasonality ofsales can have on that statistic and can sometimes provide a misleading picture of the status of accounts receivable. Days sales outstanding is the average number of days it takes a company to collect payment after a sale is made.

- Devising better strategies motivating the payment collections department to maintain a strong proactiveness in keeping outstanding accounts receivables at a minimum.

- Perhaps more important, DSO can help to spot trends as to whether it’s taking longer to collect payments from customers and determine whether credit and collections policies need to be adjusted.

- Finally, DSO is a crucial calculation to analysts who are looking to compare companies to see how well they manage credit and use receivables to grow their business.

- Low accounts receivable collection times means a company can more efficiently reinvest their cash in order to generate more sales.

Developing more comprehensive credit check policies for future clients before proposing the appropriate credit terms or exclusive payment plans for customers who have been prompt with their previous debt settlements. When sales suddenly spike, AR and DSO will likely follow suit, and vice versa. This applies to companies that experience seasonal spikes and troughs in sales, as well as cyclical companies whose sales are in lockstep with economic growth and slowdowns, such as travel and hospitality. Any immediate effect on DSO is not necessarily a reflection on a company’s performance or that of its collection department.

What are the Indications of a High or Low DSO?

Managers, investors and stakeholders rely on DSO to determine how effective a company is at collecting outstanding balances from customers. Business acquirers use the calculation to find companies with high DSO values, with the intention of procuring the business and improving their collection and credit processes. Finally, DSO is a crucial calculation to analysts who are looking to compare companies to see how well they manage credit and use receivables to grow their business. Having a low DSO value is especially beneficial for small to medium-sized businesses . Fast credit collection means the money can be sooner used for other operations.

If your day sales outstanding are high that means that the company spends more days to collect credit or accounts receivable. In contrast, the low ratio means the company credit policy or collection procedure works very well. If your company’s DSO is high, this indicates that you are waiting a long time to collect payment from your customers. A low DSO, on the other hand, indicates that your business is effiicent in collecting its accounts receivable. Your business is promptly getting the money it needs to create new business.

How to Calculate Days Sales Outstanding (Step-by-Step)

The propeller industries value depends on the size of your business, and there’s no one-size-fits-all here. For example, a DSO of 45 days may not be a problem for a large-scale business, but it is terrible for a small-scale business. Looking at companies within the same industry provides a more apples-to-apples comparison.

An up-trending DSO could mean your company offers a lot of credit sales, potentially leading to cash flow challenges. At the same time, a down-trending chart could tell cash payments come in early – a good accounts receivable turnover. In other words, it shows how well a company can collect cash from its customers. The sooner cash can be collected, the sooner this cash can be used for other operations.

What is days sales outstanding? How to calculate and improve DSO

As a result, DSO serves as a critical operational metric that firms ought to track consistently. The days sales outstanding analysis provides general information about the number of days on average that customers take to pay invoices. Generally speaking, though, higher DSO ratio can indicate a customer base with credit problems and/or a company that is deficient in its collections activity. A low ratio may indicate the firm’s credit policy is too rigorous, which may be hampering sales.

Simply put, Kolleno possesses an industry-leading all-in-one accounts receivable software platform. Its credit control solution, in combination with the company’s premium-quality customer success department, offers customised services to enable firms to manage their DSO ratios in a much more effective manner. Alternatively, analysts may want to consider other metrics, such as the delinquent days sales outstanding together with the DSO ratio, as part of investigating a company’s credit collection capabilities and efficiency. In other words, the DSO value should not be the sole factor to be considered but rather a complementing element to be viewed alongside other working capital metrics. There are a number of steps a company can take to reduce its DSO, which in turn can improve its cash flow. It can, for example, identify customers whose payments are repeatedly late and, going forward, start requiring them to pay in cash at the time of sale.

If you can’t pay your monthly operational costs, your interest payments may increase your cash burden. And if you send the account to a collection agency, they may collect a percentage of the balance. Given that John was targeting a 30-day collection period, his DSO of 31 days is good for his business. John can remain confident that his accounts receivable process is in good shape. As you can see, it takes Devin approximately 31 days to collect cash from his customers on average. This is a good ratio since Devin is aiming for a 30 day collection period.

If they don’t, mitigate the risk to your https://1investing.in/ by asking for payment upfront. Days sales outstanding benchmarks can vary significantly between industries. To gain a better insight, you should compare your company’s DSO against industry benchmarks, plus factor in economic fluctuations and your company’s capital structure and size. The average DSO is 64 days, while one in four companies are waiting 88 days or longer and 9% exceed 120 days. In the end, by calculating the Days Sales Outstanding, the company can get a great overview of its internal cash flow and any potential issues.

Online, open source and free accounting software for small businesses. Comparing a company with many customers that buy on credit to another company with many customers that pay with cash. A company that sells many holiday items may have a high DSO in the fourth quarter and low DSO in the first quarter. In that case, its DSO should be evaluated by comparing this year’s first quarter to last year’s first quarter. A high or rising DSO may also indicate a need to improve the billing/AR/collections process.

What To Expect From Walmart Stock In 2023 And Beyond (NYSE … – Seeking Alpha

What To Expect From Walmart Stock In 2023 And Beyond (NYSE ….

Posted: Tue, 28 Feb 2023 08:00:00 GMT [source]

However, whether these represent good days sales outstanding ratios is the subject of much debate. A criticism of these methods focuses on the fact the DSO ratio only gives an average and doesn’t distinguish between prompt and tardy payments. It also doesn’t accurately reflect fluctuations in payment behaviour, whereby one customer may pay promptly for one invoice and delay paying the next.

Inventory Turnover Ratio: What It Is, How It Works, and Formula – Investopedia

Inventory Turnover Ratio: What It Is, How It Works, and Formula.

Posted: Sun, 16 Jul 2017 03:22:28 GMT [source]

When you discover past-due accounts, take action to remind clients of their overdue payments. Reaching out about past due payments can be challenging and even a little uncomfortable, particularly if your ability to pay your business’s bills depends on incoming cash flow from clients. Let’s use an example of a business that has $10,000 in accounts receivable on January 1, 2020. The next month, on February 1, 2020, the business has $12,000 in accounts receivable. The business also sells $8,000 in credit sales between January 1 and February 1.

In general, having a DSO below 45 days is considered low and a good target for corporations to achieve. Indicate that the sales department has been extending credit to clients that aren’t creditworthy in order to boost sales. Thus, it is critical to not only diligence industry peers (and the nature of the product/service sold) but the customer-buyer relationship.

- Technically speaking, firms could expect with some degree of confidence that they would be paid for their outstanding accounts receivables.

- The ratio is calculated by dividing the ending accounts receivable by the total credit sales for the period and multiplying it by the number of days in the period.

- If these were taken into account, the total DSO would be considerably less.

- Alternatively, analysts may want to consider other metrics, such as the delinquent days sales outstanding together with the DSO ratio, as part of investigating a company’s credit collection capabilities and efficiency.

- This ratio measures the number of days it takes a company to convert its sales into cash.

- It could also mean your customers are less satisfied with your service.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. It suggests that the company’s cash is flowing in at a reasonably efficient rate, ready to be used to generate new business. Amanda Jackson has expertise in personal finance, investing, and social services.

Fluctuating sales volumes can affect DSO, with any increase in sales lowering the DSO value. When using DSO to compare the cash flows of a number of companies, you should compare companies within the same industry, with similar business models and revenue numbers. If you try to compare companies in different industries and of different sizes, the results you’ll get will be misleading because they often have very different DSO benchmarks and targets. As a metric attempting to gauge the efficiency of a business, days sales outstanding comes with a limitation that is important for any investor to consider. Looking at a DSO value for a company for a single period can provide a good benchmark for quickly assessing a company’s cash flow. In general, small businesses rely more heavily on steady cash flow than large, diversified companies.